42+ is mortgage insurance tax deductible 2022

Your business loss deduction is only worth. Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or.

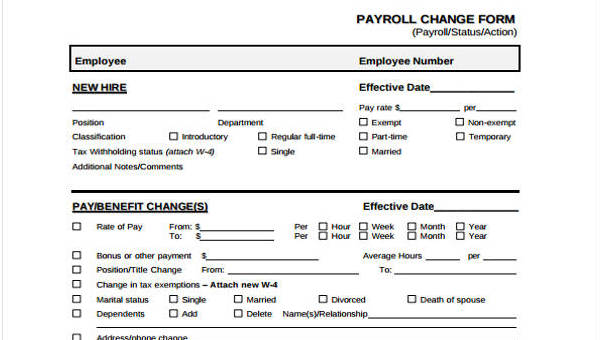

Free 42 Sample Payroll Forms In Pdf Excel Ms Word

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. Web Key takeaways. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. The standard deduction amount is indexed to inflation each year and.

Web Many home buyers are wondering if private mortgage insurance or PMI is still tax deductible in 2022. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. With all of the media publishing articles about the tax reform it is.

Web Up to 96 cash back 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. Youll usually have Private Mortgage Insurance PMI if you borrowed an amount worth 80 or more of the total purchase. Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec.

Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or. Web The PMI Deduction will not been extended to tax year 2022. So your total deductible mortgage interest is.

That cap includes your existing. Connect Online Anytime for Instant Info. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

Web 1 day agoMortgage Interest Tax Deduction Limit. Ad Ask a Tax Expert About Tax Deductible Limits. Ad Taxes Can Be Complex.

Web 2 days agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. The itemized deduction for mortgage. Web So lets say that you paid 10000 in mortgage interest.

Web Unfortunately as of April 2022 the answer is no. Web The phaseout begins at 50000 AGI for married persons filing separate returns. Web Mortgage interest.

However higher limitations 1 million 500000 if married. Web Can I deduct private mortgage insurance PMI or MIP. Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007.

And lets say you also paid 2000 in mortgage insurance premiums. Web Is mortgage interest tax deductible. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Let Us Find The Credits Deductions You Deserve. That means that the tax return you file in 2022. SOLVED by TurboTax 5841 Updated January 13 2023.

Web Homeowners insurance isnt normally tax-deductible with some exceptions. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. But you can deduct your out-of-pocket costs on your.

The total net loss that your small business had in 2021 cannot be deducted if it lost more money than it made. Web The tax deduction was scheduled to last through the 2016 tax year but it has been extended through at least 2021. Prior tax years.

Prescription eyeglasses can cost anywhere from 100 to more than 400 without insurance. Private Mortgage Insurance Deduction. Below are the standard deductions for the 2022 tax year.

But for loans taken out from. Homeowners who bought houses before December 16. Companies are required by law to send W-2 forms to.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ask a CPA Online Any Question via Chat. Get Help Calculating Tax Deductible Income.

109000 54500 if married filing separately The mortgage. In the 2021 tax year the IRS temporarily allowed individuals to deduct 300 per person those married filing jointly can. TurboTax Has Your Back.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web 1 day agoThe standard tax deduction is a reduction in taxable income that is available to all taxpayers. The PMI deduction is reduced by 10 percent for each 1000 a filers income.

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

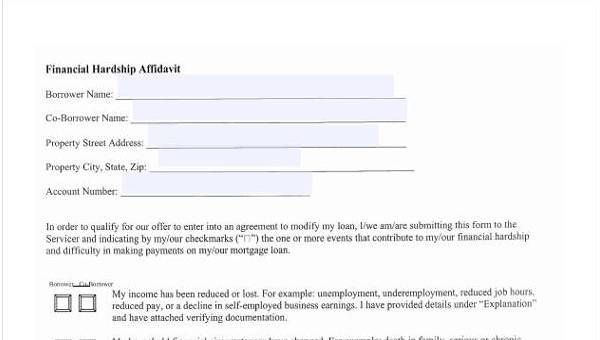

Free 42 Affidavit Forms In Pdf

Mortgage Interest Deduction How It Works In 2022 Wsj

Is Private Mortgage Insurance Pmi Tax Deductible

The Florida Horse June July 2022 Farm Service Directory By Florida Equine Publications Issuu

Lacba 2022 Southern California Directory Of Experts Consultants By Association Outsource Services Inc Issuu

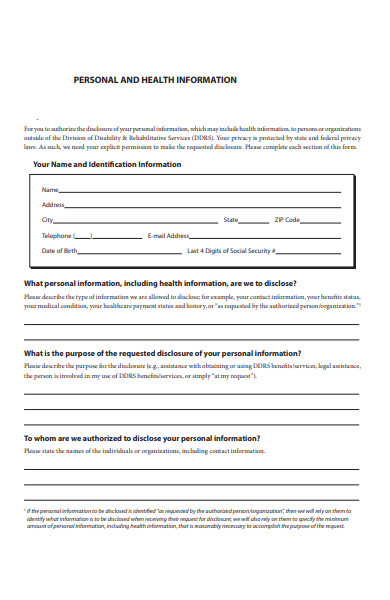

Free 42 Personal Forms In Pdf Ms Word Excel

Learn About The Mortgage Insurance Premium Tax Deduction 2023 Pakth

Sec Filing Irobot Corporation

Are Your Mortgage Payments Tax Deductible In 2022

Free 10 Mileage Log Samples In Pdf

Home Mortgage Loan Interest Payments Points Deduction

Keep The Mortgage For The Home Mortgage Interest Deduction

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Mortgage Interest Deduction What You Need To Know For Filing In 2022 Rismedia

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

5 Types Of Private Mortgage Insurance Pmi